In 2012 there were 12.6 million victims of identity theft in the United States. I was one of them. Learning my identity had been stolen was just the beginning of many challenges I continue to face daily. Feeling completely lost and with out guidance, I felt violated and overwhelmed. Two years ago I was sure I would never feel safe after my identity had been stolen. Fortunately early in the process I began using a tool that would later help me gain back my sense of security. As part of a sponsored campaign by Find Your Influence and LifeLock, I’m sharing my personal story of identity theft and how I will never take for granted the sense of personal security.

Hearing, “oh, I had my identity stolen too,” is frustrating when someone is simply referencing an experience with fraudulent charges on their credit card. Truly having your identity stolen about is so much more than money. I studied criminal justice in college and recall courses specifically about identity theft. I was an intern at the Legislature and Department of Corrections Victims Services office. I answered thousands of questions from victims of identity theft seeking assistance. I knew the statistics and risks. I knew the clumsy mistakes you could make to get yourself easily targeted. I knew the recovery process. I knew all the answers to helping yourself after you’ve been identified as a victim of identity theft. However, many years later I would understand that with out being a victim myself, I couldn’t possibly comprehend the burden and loss of personal security felt by innocent victims of identity theft.

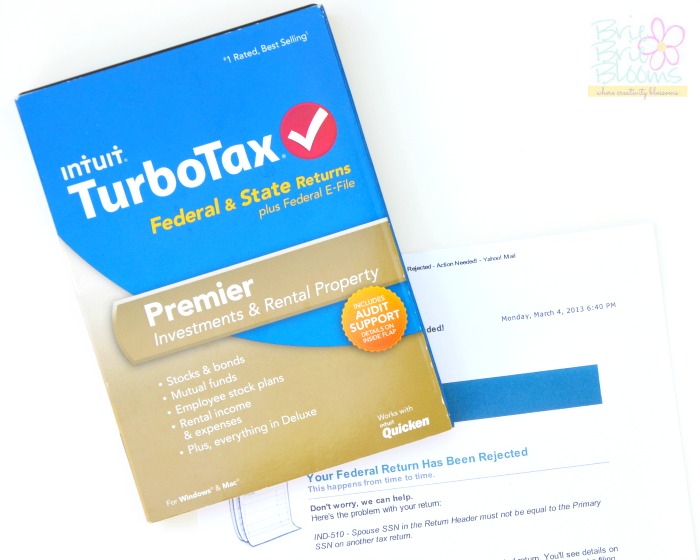

Early last year I found myself on the other end of the conversation seeking help as a victim. For years my husband and I had been filing our taxes using Turbo Tax and submitting our returns to the Internal Revenue Service (IRS) and state online. Early 2013 we filed our taxes the same way we had previously. Our file was transmitted and received. 10 days later I received a letter from the IRS addressed to me advising my tax file was pending review. My husband had filed as the primary in our household so receiving a letter in my name concerning our joint return was the first indication to us there was a potential problem. A few days later my husband received an email from Turbo Tax stating our return had been rejected because “the spouse SSN in the return header must not be equal to the primary SSN on another tax return.” Someone other than me had already used my social security number to file taxes. Panic certainly set in with that discovery because of all my experience working with victims of identity theft.

We later learned the letter from the IRS was not intended for me. It was a letter being sent to the fraudulent party advising them their tax return was under review. We should have recognized the letter came too quickly after we had filed electronically. The fraudulent return had been filed before our real return so all correspondence received early in the process was not related to the actual return filed by my husband and I. My address had been used on the fraudulent return so all correspondence from the IRS had been mailed to my home. With out knowing the details of the other return or if my social security number had been used more than once, keeping up with all the correspondence was exhausting.

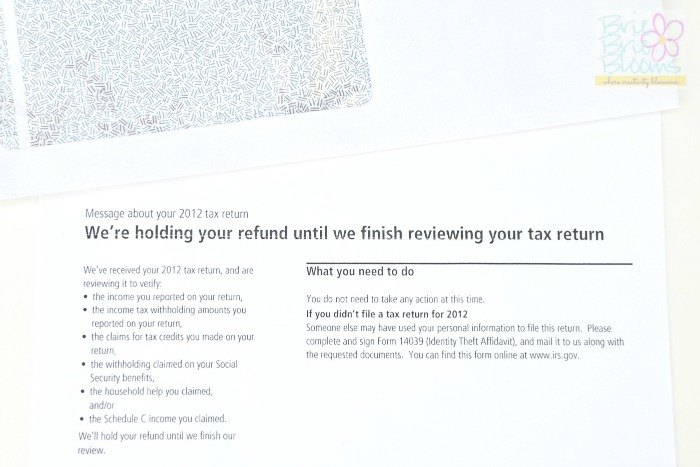

I spent two days trying to talk to a representative from the IRS through their customer service call center. Right in the middle of tax season the hold time on the phone is hours. Each time I would finally get through to a representative I was told there was nothing they could share with me because my return was under review. Trying to explain my situation to a call center representative felt impossible and my call was dropped with transfer attempts multiple times. I eventually spoke to a helpful representative that transferred me to the identity theft unit. A theft unit representative listened to my story and provided the next steps necessary to move forward with an identity theft claim. I was advised it could take up to 36 months to be resolved. The large tax return we had expected would be held for up to 3 years. Additionally, I learned I would never again be able to file my taxes and submit electronically with out using a pin later assigned by the IRS. The representative was not able to share the specific details of the other tax return filed but I did learn the fraudulent party had used my name and home mailing address in the return with work information matching mine. The thought of someone else posing as me was chilling. It wasn’t until months later I learned state returns were also filed fraudulently making me feel nervous everywhere I went. Could I accidentally end up standing next to the person pretending to be me? It was a sickening fear. With little information and a big list of items requiring immediate attention, I was determined to move through the process and quickly receive our tax return.

First on my list of items to do was filing a police report and resubmitting our tax return attached to an affidavit of identity theft. Sounded easy. Unfortunately the paperwork submitted to the IRS needed to include a copy of the police report which can only be obtained after it has been filed with the court, a step in the process taking several weeks. I completed the police report in person at the police station and then waited. A full month later I was finally able to pick up a copy of the report and provide it to the IRS for review. In the meantime I had started receiving mail I didn’t recognize addressed to me at my home. I had received no follow up from the IRS and called frequently for updates. I was told no new information could be shared and I would receive notice in writing with any changes.

Months later I received a check addressed to me in the amount similar to our expected return. The check was from a third party bank and noted the payment as my tax return. Recognizing we had not received any correspondence from the IRS regarding the claim resolution, we went to our local IRS office. By this point we had decided waiting a couple of hours in line to speak with a representative in person was a better option than spending hours on the phone with out resolution. We learned the person posing as me filing the fraudulent claim had used a third party processing agency to submit their return initially. When it couldn’t be paid electronically (to the fraudulent person’s banking account) because of the review from the IRS, the check was sent to my home address as it was the physical address on file. Our first question was why the claim was paid. We learned the IRS had mistakenly paid the fraudulent claim because the identity theft alert was only added to my husband’s name in the IRS database. Because I was not the primary filer on our joint tax return, the system overlooked the alert and mistakenly paid the the fraudulent party. The representative in the office said he would look into the next steps as he had never seen that type of mistake made before and would follow up with us. He later called to tell us we needed to make an appointment to return to the office and sign over the check. We made an appointment for the following week. In the meantime, due to the brief government shut down, our local IRS office was closed and we were not able to sign over the check in person. A month later when the office was reopened we signed over the check.

To date, we know nothing about the person who stole my identity. To our knowledge there have been no related financial crimes outside of the tax filing. With so many potentials and fully knowing the likelihood of personal credit damage, I was terrified. It’s so much more than just money we are concerned about. If the person who stole my identity was working in the same state they could eventually start collecting from my state retirement fund. Bank accounts could be opened. Medical records could be shared. My social security number has already been compromised and I have no idea where or how it has been used. The thought of someone assuming my identity and causing hardship to my family is scary. If this other person is committing crimes, I could be held responsible. If there are outstanding tickets or worse, a warrant, for this person a simple traffic stop could result in me being arrested. Having my daughter with me in the car 99% of the time I’m driving, that potential is terrifying.

The IRS identity theft unit agent provided a few tips when we initially spoke. She suggested immediately using a credit monitoring service like LifeLock.

There is no way to fully know the extent to which my personal information has been compromised but by using LifeLock, I will receive immediate alerts each time my social security number is detected on an application for credit. The service uses 5 points of protection 24 hours a day. Using LifeLock has helped me gain back my sense of personal security while knowing someone is out there pretending to be me.  How doe the 5 points of protection work?

How doe the 5 points of protection work?

- Monitoring your identity

- Scanning for identity threats

- Responding to identity theft

- Guarantee for their services

- Tracking your credit score

The LifeLock Ultimate credit monitoring service alerts you each time your personal information has been used including to open new accounts. You are also notified if your information appears in criminal searches, payday loan applications, and used for address changes. All of my concerns are taken away knowing LifeLock will notify me immediately when my information has been used. I have personally been alerted multiple times by email and text message when I have done something to trigger concern from LifeLock. For example, minutes after submitting a credit application, I was alerted by LifeLock of the activity using my social security number. The alert requires you to call and verify the activity. Contacting LifeLock is easy and from my own personal experience, their customer service is fantastic. Being able to reach a representative any time of the day or night is certainly helpful because I work daytime hours.

If you’re already using LifeLock, congratulations for taking the necessary steps to protect yourself. The only criteria to being personally affected by identity theft is having a social security number. Although it was just my identity stolen, my husband and daughter are also protected by LifeLock. I will always wonder about how my identity was stolen but LifeLock has given me back my sense of personal security. I’m no longer panicked by the thought of someone using my information because I know I will be immediately contacted by LifeLock. Get started protecting yourself today with a 10% off promotional code for new members.

Use “LifeLockSecure” to receive 10% off your LifeLock membership!

Have you been personally affected by identity theft too? Learn more about the ultimate credit protection on the LifeLock website and by connecting with LifeLock on Facebook and Twitter.